Dear Student,

This letter was accompanied by a packet and web links with details about scholarships, loans and costs. But many educational and consumer experts think students should not have to wade through lots of papers and websites to get the information they need to make wise decisions. They say colleges can and should provide one complete, jargon-free and easy-to-compare page with realistic cost estimates. To read about why you deserve better, how we evaluated these letters, and how you can evaluate your own letters, click here. Of course, we hope anyone making important life decisions will check with their own trusted financial and personal advisors, not just websites - not even this one!

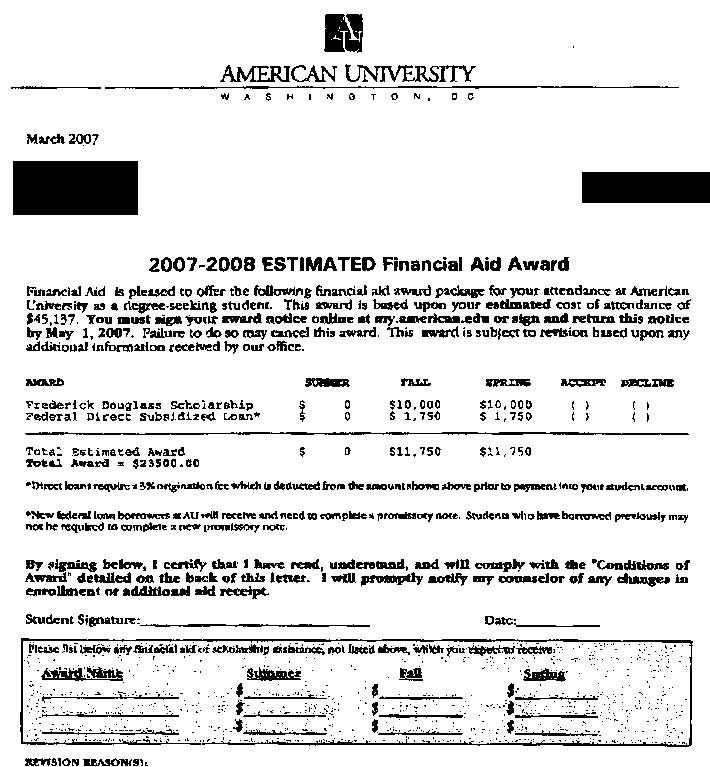

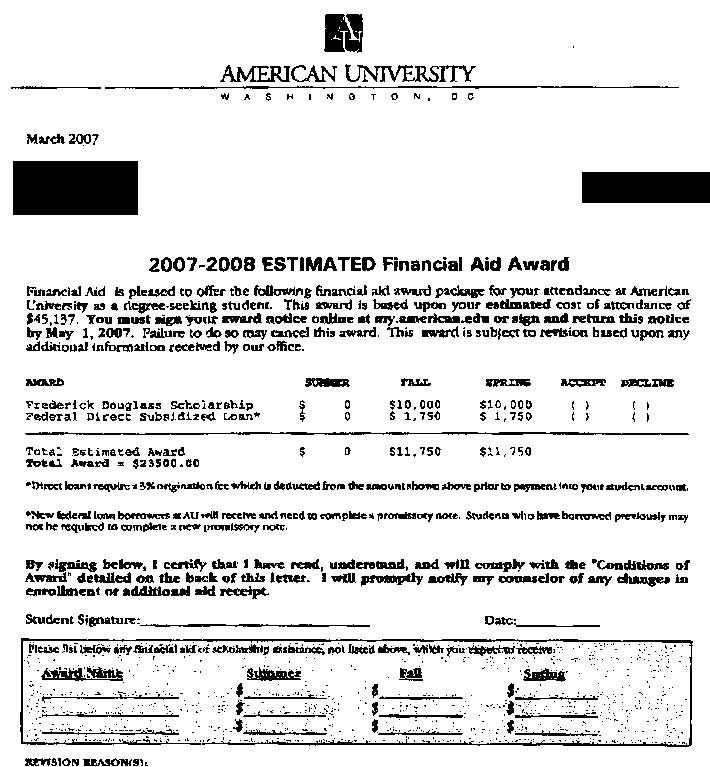

From American University's Associate Director of Financial Aid, Selena Healey:

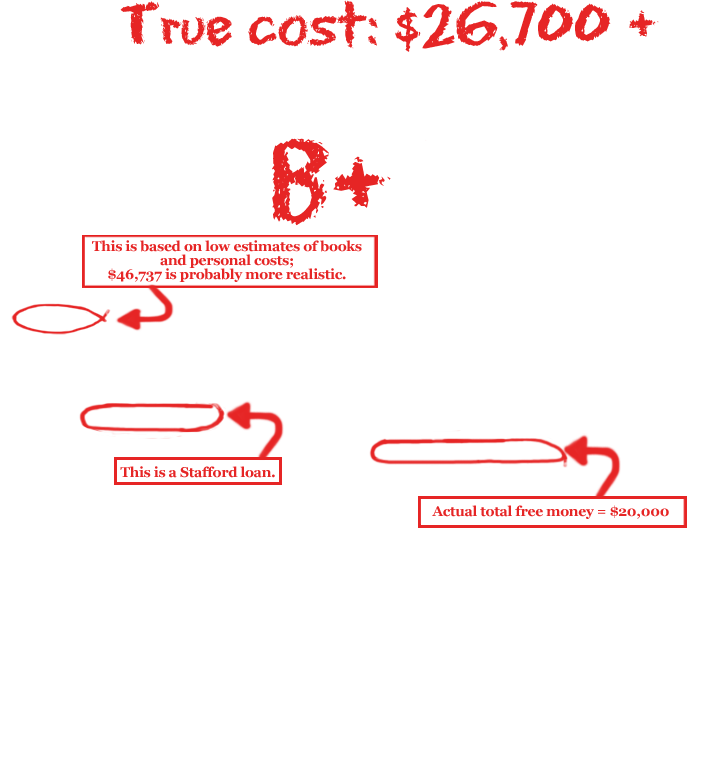

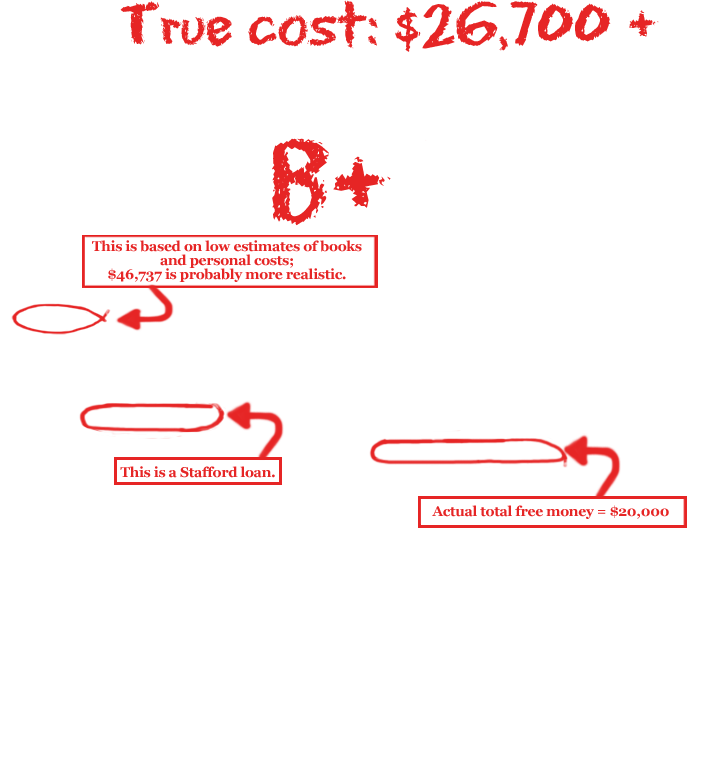

Cost of Attendance: American's total Cost of Attendance is based on the assumption that students will spend just $600 for books, $700 for travel and $600 for personal expenses in the coming school year. This gives a total cost at least $1,000 lower than the average suggested by the College Board, a non-profit association of most colleges and universities. The College Board estimates (on page 6 of this PDF) that the average college student spent about $935 on books, more than $700 for travel, and $1,300 to $2,000 on personal expenses last year. Healey says American financial aid recipients who find their costs exceed American's estimates can "submit a written request itemizing the expenses in questions and attaching supporting documentation such as receipts verifying their actual numbers. These requests are reviewed on a case by case basis, and the Cost of Attendance will be increased for the items allowed by federal regulation. The majority of our students do not appeal any of these items, so I do not have any reason to believe they are too low. I would hesitate to increase these figures because a higher Cost of Attendance would encourage students to borrow more when perhaps they do not need to in the first place."

From Financialaidletter.com:

Clarity:

- Unlike many other schools, American warns students to subtract 3 percent, (in this case, $105) from the value of the loan. That money will go to pay borrowing fees and can't be used to defray tuition or other educational expenses. But John Kozup, director of the Villanova University Center for Marketing and Public Policy Research, notes that the fee information is in small type.

- Unlike many other schools, American informs students that they have the option of declining an offered loan, notes David Hawkins, director of public policy for the National Association for College Admission Counseling.

Cost:

- When estimating how much it will cost to get a degree from this school, consider that 63 percent of American University students graduate in 4 years.