Dear Student,

This letter was accompanied by a packet and web links with details about scholarships, loans and costs. But many educational and consumer experts think students should not have to wade through booklets and websites to get all the information they need to make wise decisions. They say colleges can and should provide one complete, jargon-free and easy-to-compare page with realistic cost estimates. To read details about how we evaluated these letters, and how you can evaluate your own letters, click here. Of course, we hope anyone making important life decisions will check with their own trusted financial and personal advisors, not just websites - not even this one!

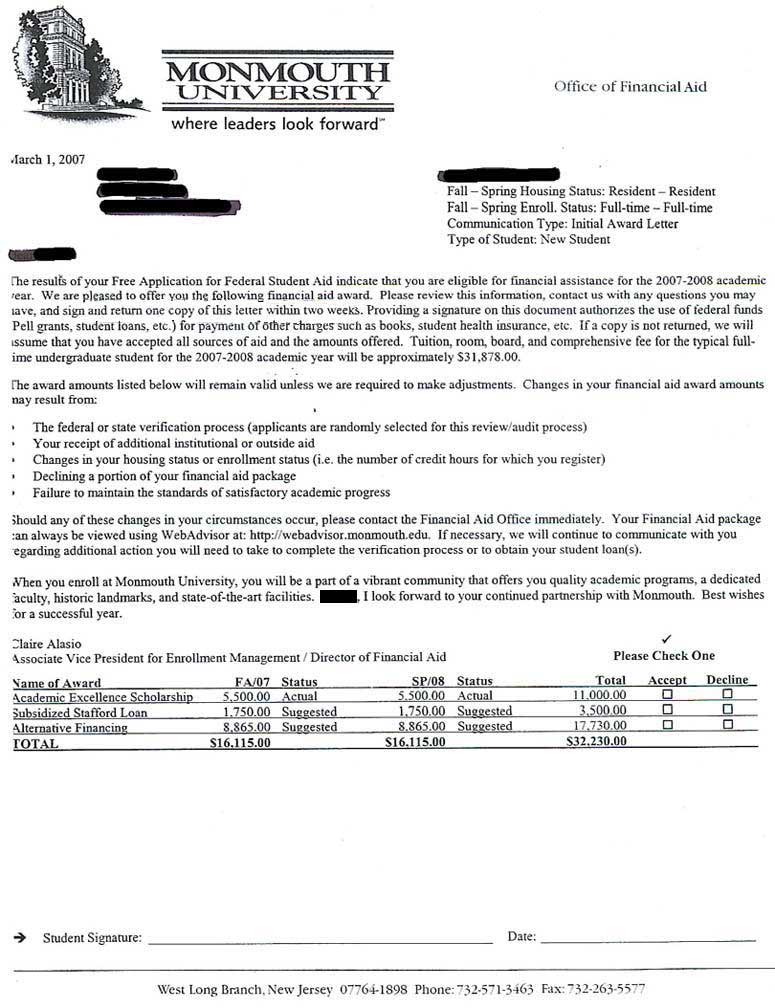

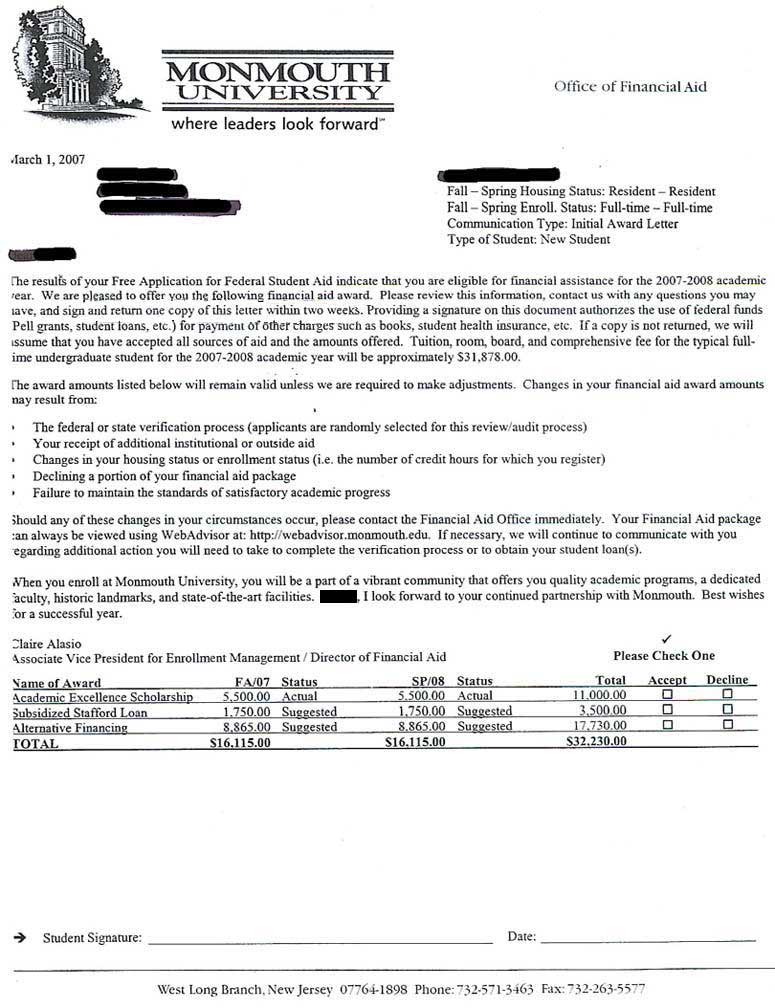

From Monmouth?s Associate Vice President for Enrollment Management and Director of Financial Aid, Claire Alasio:

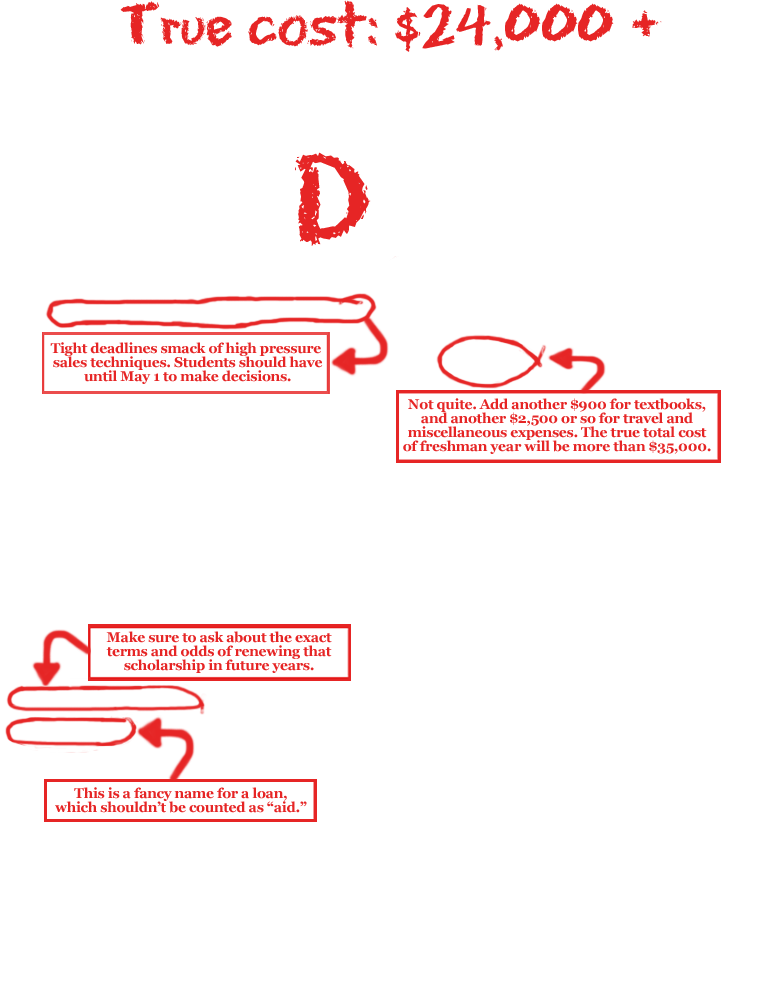

Cost of Attendance: Students get detailed information about the costs of tuition, fees, room and board in the packet that accompanies this letter and on Monmouth's website. Alasio doesn?t like to specify a total Cost Of Attendance (COA) on the letter because it varies so much for each student depending on their coursework, distance from school and spending habits. Monmouth did not provide a COA on its website when Financialaidletter.com checked in March. Federal law requires colleges to provide students with COA estimates. Alasio said that the absence of the COA information from the website was simply an oversight. Monmouth uploaded COA information to its website April 10.

Alternative financing: Alasio says she uses the ?deliberately vague? term ?alternative financing? so that parents who don?t qualify for a PLUS loan will understand they can still find other kinds of loans.

Deadline: Despite the short deadline in the letter, Alasio says she?d give students more time to make their decisions. ?If you?re not coming, we?d like to know so we can allocate the aid to other students, but we?re not rigid about the deadlines,? she says.

From Financialaidletter.com:

Clarity:

- No total Cost of Attendance.

- Makes an ?alternative? loan look like aid. Loans have to be repaid. And many alternative loans are made by for-profit companies on the open market, and thus are not any special deal.

- ?The family needs the letter to have more ?next steps?? explained, says Mark Kantrowitz, founder of Finaid.org.

Cost:

- Although the federal government calculated that this family could only contribute about $10,000 a year to the student?s educational costs, one year at this school will cost this family at least $24,000. To put it another way, the student needed $25,000 in aid, but the school only provided $11,000, or about 44 percent of the student?s need.

- Students trying to figure out how much it will cost to get a degree should consider that just 35 percent of Monmouth undergraduates graduate in 4 years.